Awe-Inspiring Examples Of Info About How To Decrease Credit Card Interest Rate

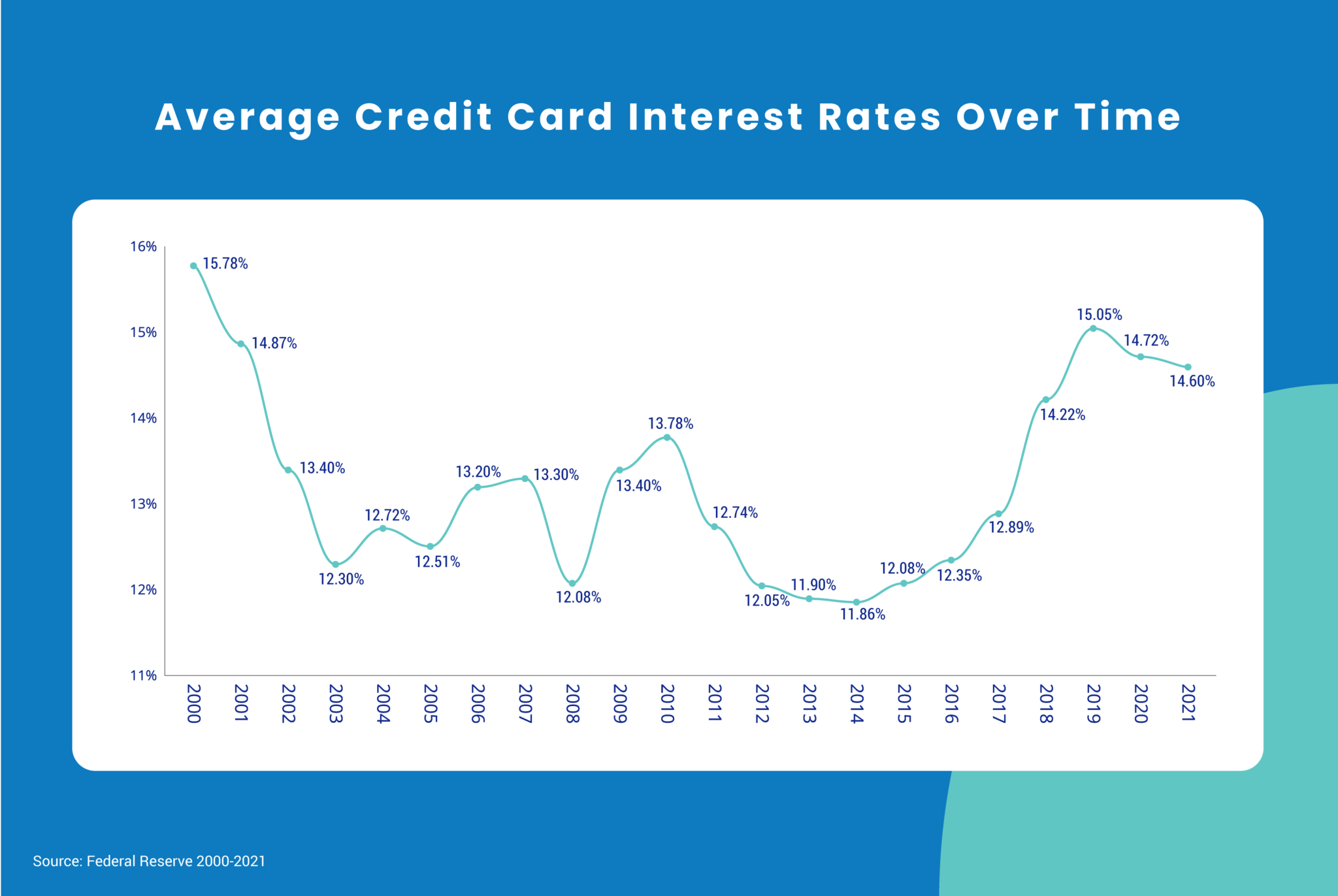

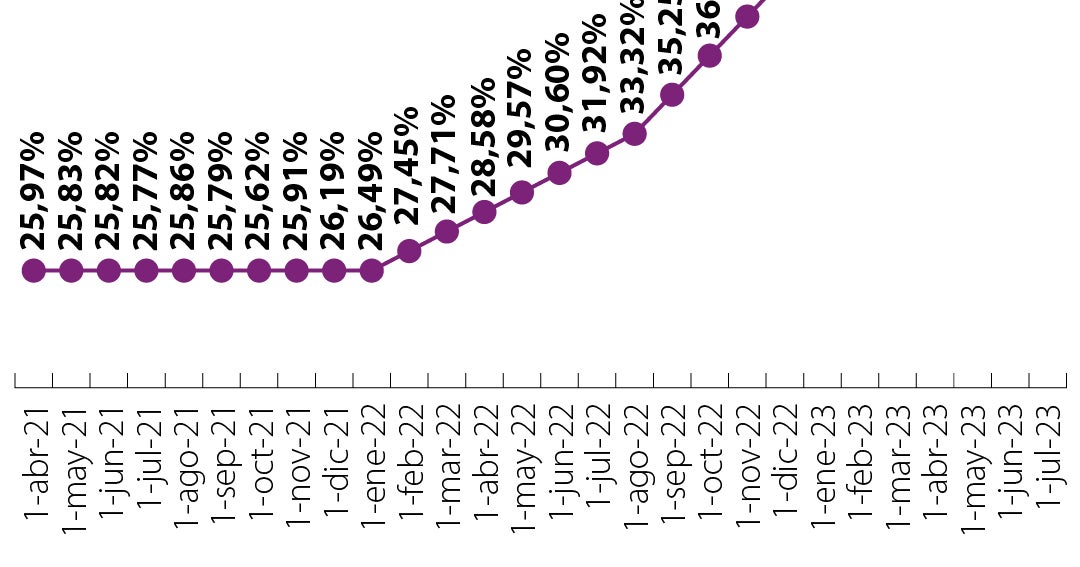

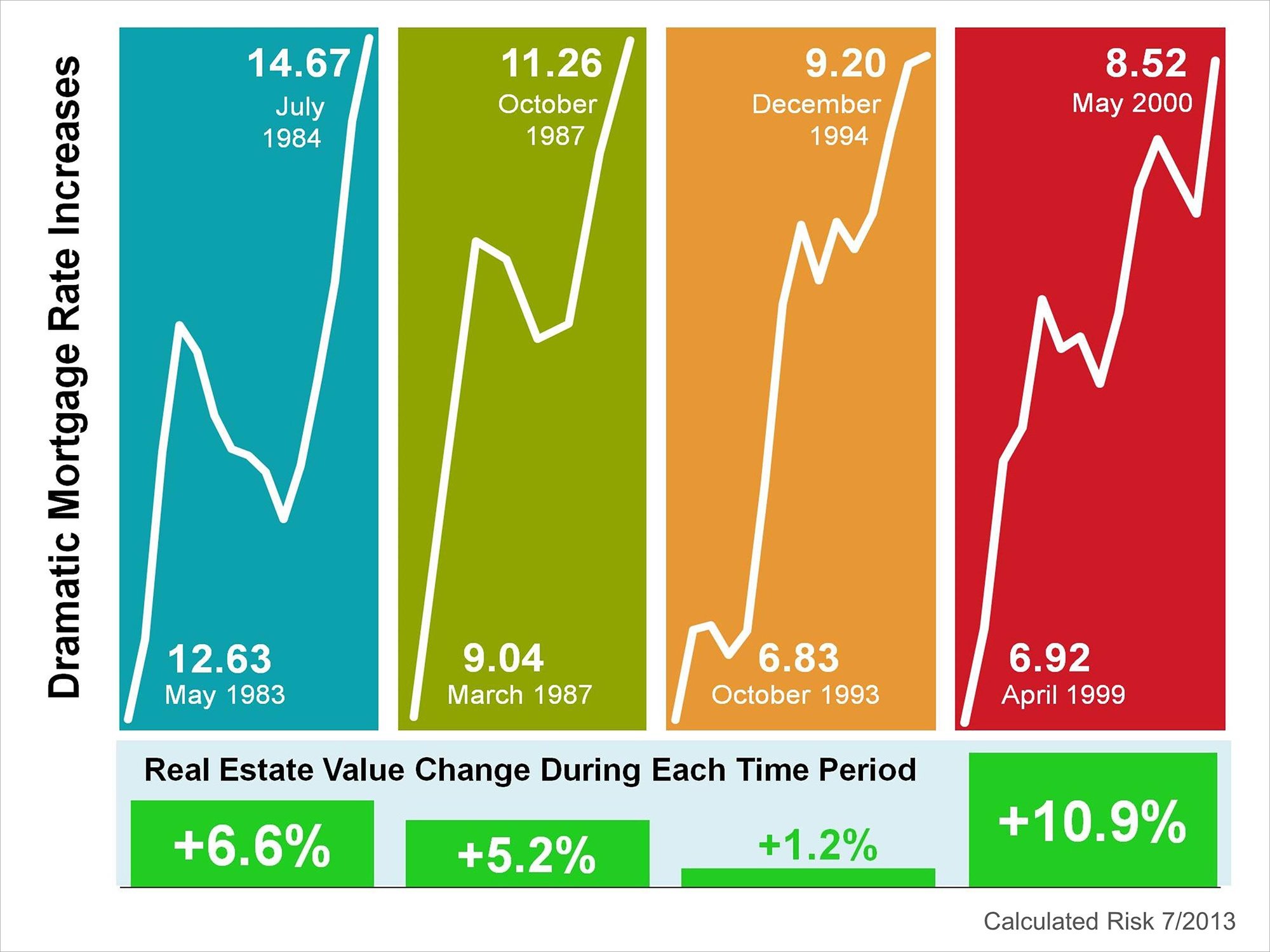

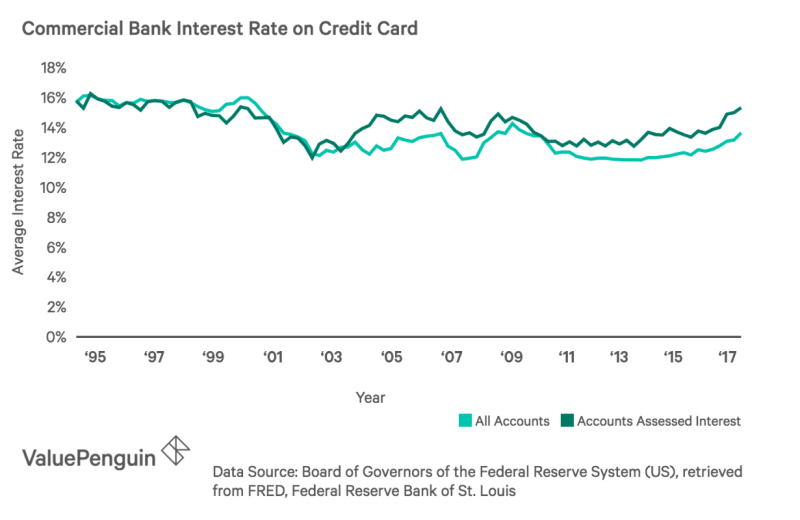

Since the start of 2022, this figure has increased by 4.44.

How to decrease credit card interest rate. The interest rate (known as apr) you pay on your credit card is part of your. Know that to be successful in. A record $1.13 trillion in debt ended up on credit card balances during the fourth quarter of 2023, according to the latest report on household debt from the federal.

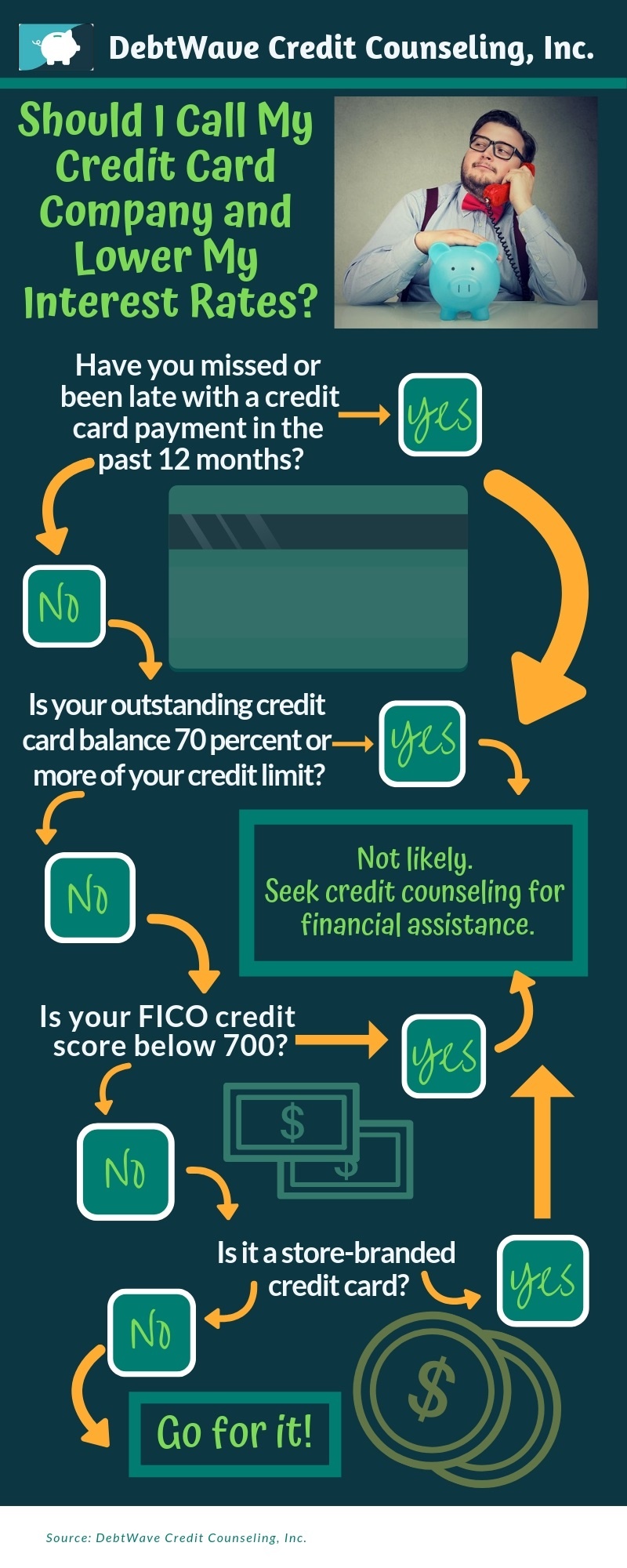

With rising interest rates impacting consumers everywhere, credit card users may be wondering how to get lower interest rates on credit cards. Look up the apr on your credit card: Many people in troubled situations may inquire about closing their accounts altogether because it is too expensive to maintain.

If you’re unhappy with your credit card’s interest rate, also known as an apr, securing a lower one may be as simple as asking your credit card issuer. The daily rate is usually 1/365th of the annual rate. Here are four steps that can help you secure a lower interest rate on a credit card you already have.

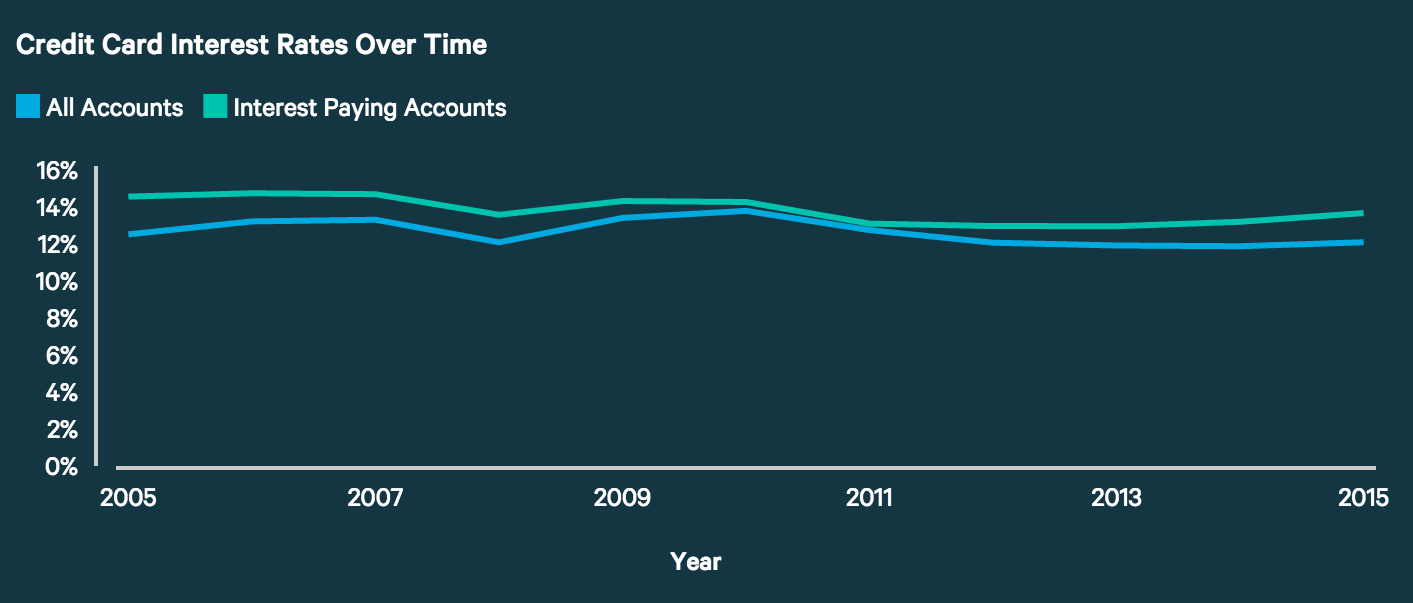

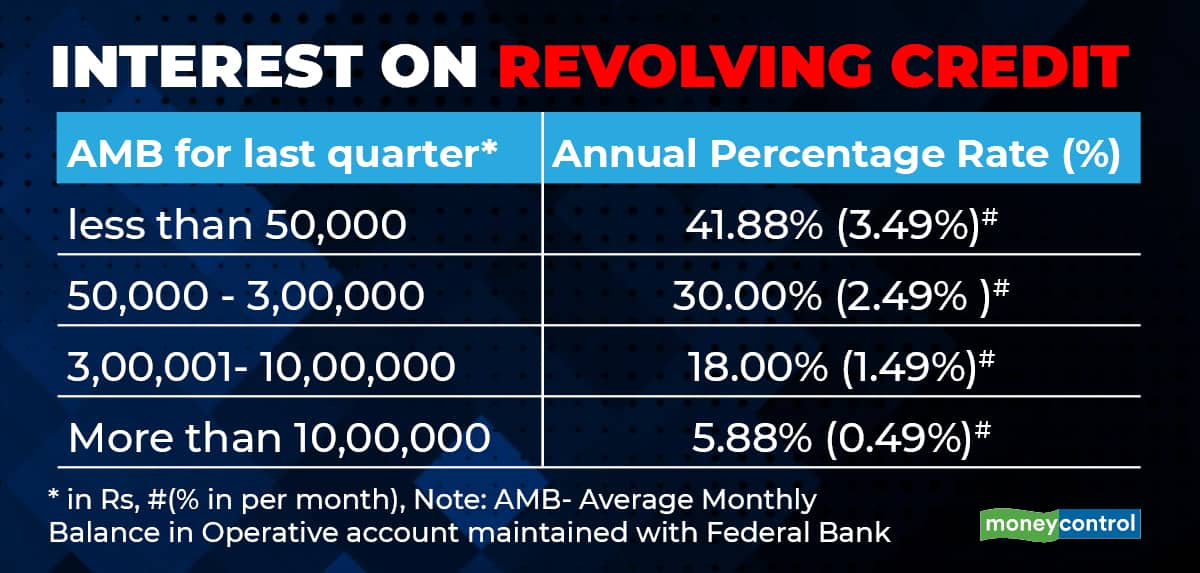

Although the stated rate is an annual rate, credit cards typically charge interest on a daily basis. How to lower your credit card interest rate knowledge is power. Improve your credit score an improvement in your credit score is critical if you want to start reducing the apr you're being offered by lenders on credit card applications.

For cardholders with “good” credit — a credit score of 620 to 719 — the typical interest rate charged by big banks was about 28 percent, compared with about. Next, move to the account with the next highest interest rate and repeat the process until you pay off all of your credit card balances. A $7,000 balance on an account with 20% apr, for instance,.

Steps to calculate credit card interest: However, it is important to note that you typically must have good or excellent credit to qualify for such offers. Obtaining a lower interest rate can result in paying less interest over time, making it more than worthwhile to ask.

One of the easiest ways to stop incurring credit card interest is to move your debt from your current card to one with a 0% apr offer for balance transfers. American express, chase, citi, discover and wells fargo. (investigatetv) — according to a credit card debt study by nerdwallet, 89% of.

The median interest rate for people with good credit — a score between 620 and 719 — was 28.20% on cards from from large issuers and 18.15% for small. Bankrate reports the average credit card rate on jan. If you can’t afford to pay more than $150 a month toward your credit card, for example, a $5,000 balance on a card with a 24 percent apr could take you nearly five.

Credit card interest rates for 2024. It took me about 45 minutes to call or chat with all five of the credit card issuers: Assess your credit health before making any big ask of a lender.

Americans hold a collective $1.2 trillion in credit card debt as of september 2023. In some cases, you may even qualify for a 0% apr on a credit card for a limited period.

/images/2019/07/11/woman-calculating-average-credit-card-interest-rate.jpg)